The construction industry in Indonesia is the fourth-largest contributor to the country’s gross domestic product (GDP). It is also one of the largest markets for investment in construction sectors in the Southeast Asian region. In 2022, it is expected to enjoy a compounded annual growth rate (CAGR) of 4%, and 7.2% in real terms.

At the height of the COVID-19 pandemic, construction activity continued in Indonesia as it is classified as essential work. Government support has been crucial in the recovery of the industry, as more infrastructure projects to develop the archipelago’s connectivity are implemented. Despite the delays caused by the pandemic, Indonesia’s construction market outlook for 2022 is showing prospects for broad growth.

What lies in the future of construction in Indonesia? How can the industry sustain its productivity and profitability as it recovers from the pandemic? Let's look at the current market and the opportunities in store for businesses.

Indonesia’s construction market size in the housing and industrial sectors is expected to drive the industry’s growth this year. Apartments and landed houses are the two largest segments in the residential construction sector. The retail category, which includes shopping centers, retail outlets, and shophouses, also show an upward trend.

Infrastructure development plans of the Indonesian government also help drive the growth of the market in the country. Government investments are crucial to the development of the construction industry in Indonesia. During the pandemic, the government had to re-allocate its budget for infrastructure toward COVID-19 relief measures, causing delays in infrastructure projects that impacted the industry.

The Indonesian government announced a public infrastructure development plan with a plan to invest up to 430 billion USD in infrastructure projects. This includes the construction of six new airports, 6,624 kilometers of railways, and 205 kilometers of new roads. The Indonesian Ministry of Public Works also plans to expand its toll network by 3,000 kilometers by 2024.

With the announcement of the relocation of its capital city from Jakarta to Nusantara, the government also laid out plans for the development of the central government area in five stages to 2045. Currently, roads, water systems, and a dam are being built in the area, which covers 256,000 hectares of land.

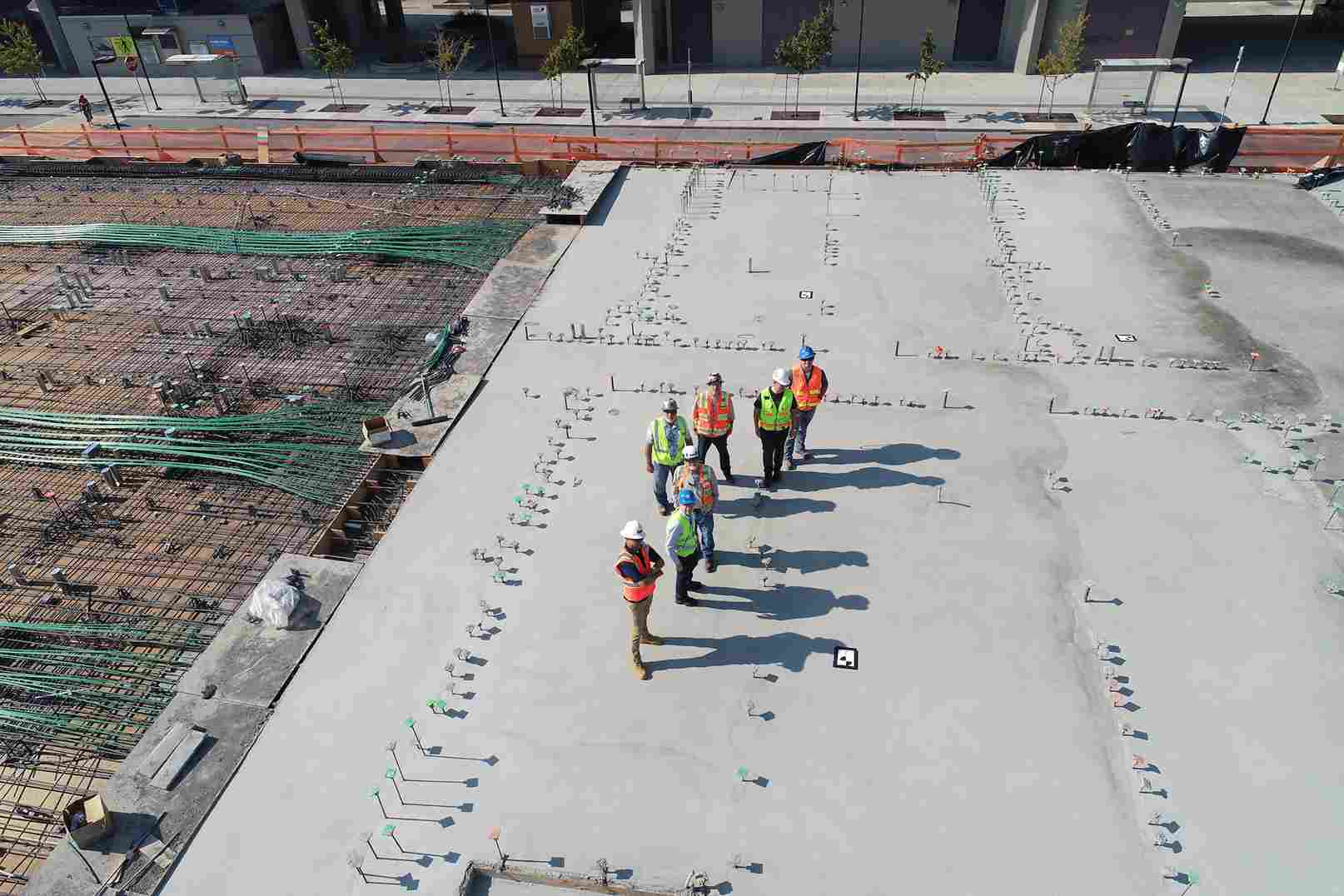

With the development projects in Nusantara and infrastructure construction well underway this year, Indonesia’s construction market outlook for 2022 remains strong. The first stage of development for the new capital city has started, and public works dedicated to connecting the archipelago are driving the industry’s growth. This expansion is expected to continue in the long term.

The industry is dominated by small companies, making up more than 80% of all construction companies in Indonesia. These businesses, while not having as much capital and equipment as larger companies, are able to handle smaller-scale projects for residential and commercial establishments. While competition with large contractors can be tough, especially for infrastructure projects, these small companies can also benefit from private sector projects and government investments in the construction industry in Indonesia.

The ongoing growth of Indonesia’s construction market size from public works, residential projects, and retail developments shows promise for the future of construction in the country. Despite delays caused by the pandemic, Indonesia is back on its feet and focusing on public development. As other industries also continue to recover, construction projects will follow, promising a bright outlook for the industry in Indonesia.

Revolutionizing Finance: An Overview of Digital Lending in Southeast Asia

Digital lending is poised to become the primary revenue driver for digital financial services in Southeast Asia (SEA) by 2025, outpacing digital payments. This growth is fueled by a 33% annual increase in digital lending, supported by technological innovations such as automated loan origination processes and seamless integration of financial services into digital experiences. These advancements have made it easier for consumers to access financing for various needs, including online shopping, travel bookings, and ride-hailing services.

IoT Integration in the SEA Automotive Lubricants Market

The Southeast Asia (SEA) automotive lubricants market is rapidly evolving with the integration of Internet of Things (IoT) technology. This transformation offers significant benefits, creates new opportunities in smart technology, and introduces innovative IoT solutions that can revolutionize the industry.

Embracing Robotization: Challenges and Opportunities in Industry 4.0

Robotization presents challenges and opportunities for businesses and the workforce, requiring companies to embrace this transformation.

Opportunities in the Indonesian Skincare Market

The rapid growth of the Indonesian skincare market presents significant opportunities for the beauty industry. Projections indicate a steady growth trajectory of 4.6% over the next five years, reflecting sustained consumer demand and market expansion. In this article, we will explore the various opportunities that the Indonesian skincare market presents for brands seeking to establish a strong foothold and thrive in this dynamic landscape.