In today's digital era, changes in technology trends and customer behavior have compelled businesses to be more agile and can quickly adapt to the rapidly evolving market. For the banking industry, the need for digital acceleration has become a top priority in order to stay competitive.

With about 260 million people, Indonesia poses tremendous opportunity for digitalization in banking. While several local retail banks have started to digitize their business processes, many remain to focus on enabling basic customer transactions to this day.

More importantly, only 36% of Indonesia’s population is connected to formal financial institutions, leaving an estimated 150 million citizens unbanked. The financial gap of 75 USD would need to be immediately addressed by banks and Fintechs.

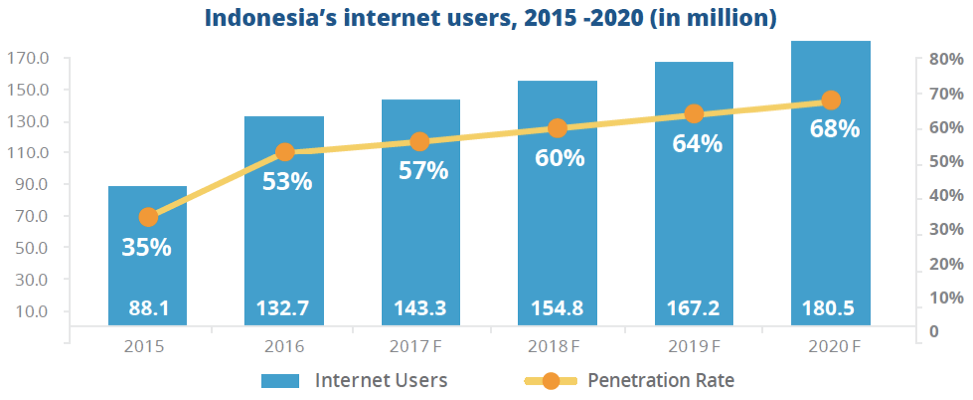

Driven by the availability of affordable smartphones and accessibility to mobile internet, Indonesia’s internet penetration is expected to boom at a CAGR of 8% from 2015 – 2020.

The shift in demography, which continues to be dominated by the millennial generation, has also urged banks to start addressing their financial needs. With customer behavior rapidly shifting across generations, the customer’s banking journey will no longer be linear. Mobile devices and social media play a crucial role in various parts of a customer’s engagement cycle.

The Advancement in technology will significantly affect the banking industry. Innovation will continuously grow in every area of the value chain due to the relentless speed of digitization and automation. The rise of tech startups, including fintechs, and regulatory initiatives urge financial institutions to be more transparent and data-driven.

Availability in connectivity Infrastructure, combined with the expectation of increased smartphone penetration, internet penetration as well as a growing young affluent customer segment, are factors that enable digital retail banking penetration to reach 60% by 2020.

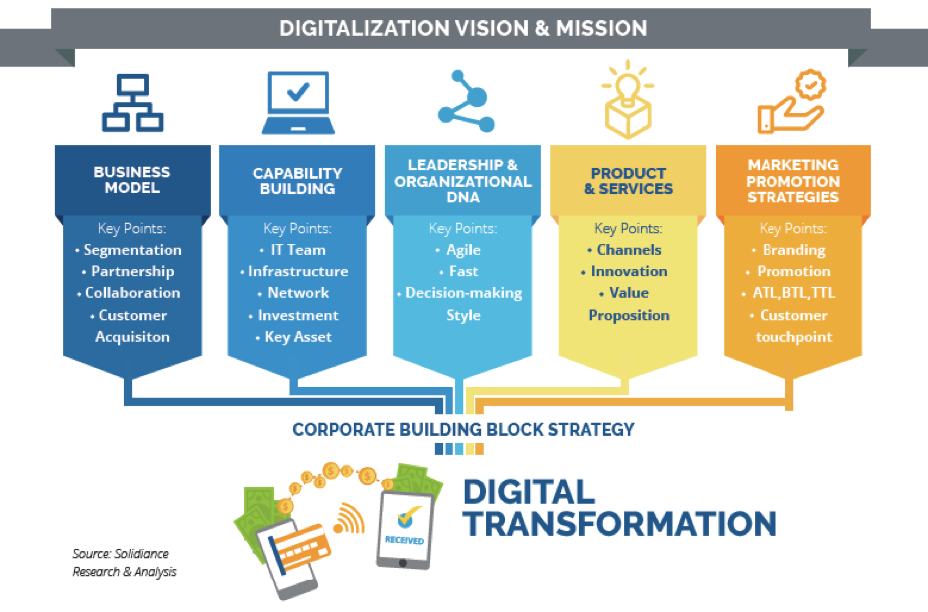

In order for companies to transform in the digitalization era, Solidiance believes there are 5 core competencies needed to be aligned with corporate vision and mission. “Creative and fresh ideas or initiatives in every pillar become the key success factors in building successful corporate digital transformation strategies”, remarks Gervasius Samosir, Associate Partner at Solidiance.

In Solidiance’s recently-released white paper “Digital Evolution in Indonesia’s Banking Industry”, we seek to give an understanding into Indonesia’s current banking industry against the backdrop of today’s digital era and tech-savvy population. A number of key trends are showing that consumers are engaging differently with their financial service providers, driven largely by the shift in customer behavior and expectations.

Revolutionizing Finance: An Overview of Digital Lending in Southeast Asia

Digital lending is poised to become the primary revenue driver for digital financial services in Southeast Asia (SEA) by 2025, outpacing digital payments. This growth is fueled by a 33% annual increase in digital lending, supported by technological innovations such as automated loan origination processes and seamless integration of financial services into digital experiences. These advancements have made it easier for consumers to access financing for various needs, including online shopping, travel bookings, and ride-hailing services.

IoT Integration in the SEA Automotive Lubricants Market

The Southeast Asia (SEA) automotive lubricants market is rapidly evolving with the integration of Internet of Things (IoT) technology. This transformation offers significant benefits, creates new opportunities in smart technology, and introduces innovative IoT solutions that can revolutionize the industry.

Embracing Robotization: Challenges and Opportunities in Industry 4.0

Robotization presents challenges and opportunities for businesses and the workforce, requiring companies to embrace this transformation.

Opportunities in the Indonesian Skincare Market

The rapid growth of the Indonesian skincare market presents significant opportunities for the beauty industry. Projections indicate a steady growth trajectory of 4.6% over the next five years, reflecting sustained consumer demand and market expansion. In this article, we will explore the various opportunities that the Indonesian skincare market presents for brands seeking to establish a strong foothold and thrive in this dynamic landscape.